If a deposit has already posted to your account, you can order a copy of a past deposit slip online or select View Details beside the deposit if you are already signed on.

- Wells Fargo's general policy is to make deposited funds available on the first business day after the Bank receives a deposit. In some cases, however, we may place a deposit hold on these funds and delay availability for up to 7 business days. Refer to your deposit receipt for information about the hold.

- Using a certified scanner, computer, and Internet connection, or simply an iPhone, iPad, or Android device, you can deposit checks through the Commercial Electronic Office® portal or through the CEO Mobile® Deposit service. Wells Fargo Electronic DepositSM service.

If the deposit has not yet posted, or if the deposit was made to an account you do not access online, call us at 1-800-TO-WELLS (1-800-869-3557). Please have your Transaction Receipt available when calling.

And balance a deposit, and second company user to approve that same deposit before transmitting it to the bank – A deposit approver is an internal approver within your group, not an approver at the bank (you can have multiple deposit approvers) – If you request the deposit approver role, it applies at the account-level (all deposits.

More information about deposit slip photocopies:

- You may obtain a photocopy of a deposit slip within seven years of the deposit date.

- Please allow up to ten business days for delivery.

- You may also request copies of the checks that were included in the deposit.

- A Document Copy Fee may apply when Wells Fargo provides you with a paper copy of a deposit slip and/or the accompanying checks. For additional information, please refer to your Consumer Account Fee and Information Schedule, or call us at 1-800-TO-WELLS (1-800-869-3557).

To order new blank deposit slips, call 1-800-TO-WELLS (1-800-869-3557) or sign on to access Order Checks and Deposit Tickets on Wells Fargo Online.

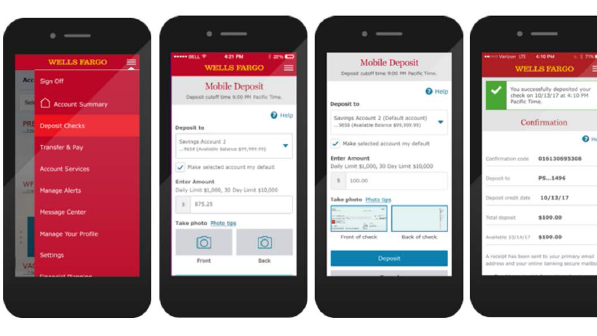

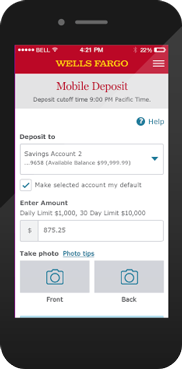

Wells Fargo Check Deposit App

Streamline your receivables

Every paper transaction you convert to electronic helps to add speed and increase your ability to monitor overall cash flow.

Put your collections online

Our electronic receivables can change the way you do business, which may help you:

- Streamline your A/R process.

- Increase transaction accuracy.

- Speed up collections.

- Decrease fraud risk.

- Improve customer satisfaction by accepting more payment formats.

- Reduce float and receive your payments faster.

Remote Deposit

Wells Fargo Check Deposit Policy

When you deposit checks from your place of business, you can improve cash flow and receive information quickly while helping reduce the time, cost, risks, and waste resulting from physically transporting check deposits.

Wells Fargo has two ways to help you make remote deposits:

Desktop Deposit® service

Using a certified scanner, computer, and Internet connection, or simply an iPhone, iPad, or Android device, you can deposit checks through the Commercial Electronic Office® portal or through the CEO Mobile® Deposit service.

Wells Fargo Electronic DepositSM service

Using your existing process to capture check images and data, you can create and securely transmit a file to Wells Fargo.

The Wells Fargo advantage

- Extended deposit times. You have an extended deposit deadline for same-day ledger credit of 7 p.m. PT/ 10 p.m. ET.

- Lower bank fees. You can consolidate banking relationships, which may save money on account maintenance fees, and help you reduce time reconciling multiple bank accounts.

- Access to deposit images for up to seven years. An extended deposit image archive lets you view all your paper and electronic deposits online using the Transaction Search service.

- Benefits for your business and the environment. Not only will your company save on the cost of transportation and insurance associated with taking checks to the bank for deposit, but you’ll also reduce your ecological footprint by eliminating CO2 emissions.